The US Energy Information Administration published the report “Low oil prices have affected Russian petroleum companies and government revenues”.

According to the report, low oil prices are having a significant affect on the Russian state budget due to lower tax revenues from the oil and gas companies. However, the oil companies themselves aren’t feeling the squeeze, since the design of the Russian tax system allows for companies to pay lower taxes amidst lower oil prices. Therefore, the companies, which have their operations denominated in local currency and revenues in dollars, can keep a larger share of revenues, and continue to increase their spending in ruble terms.

In Russia, oil and gas companies pay a mineral extraction and export tax, but there is no profit-based taxation.

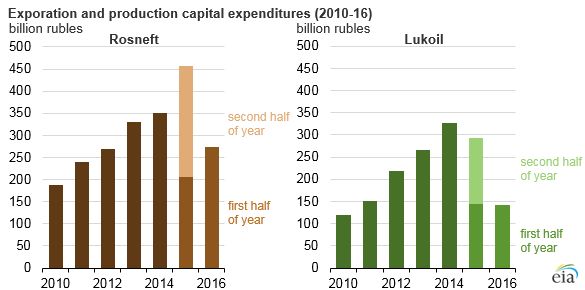

“The favorable tax structure and exchange rate for Russian oil companies, the subsequent continued high investment levels at Rosneft, Lukoil, and other Russian oil and natural gas companies,” the report published on October 20, said.

The Russian government is expected to overhaul the tax scheme, but is met with opposition from the energy companies, who argue more taxes will stunt investment.

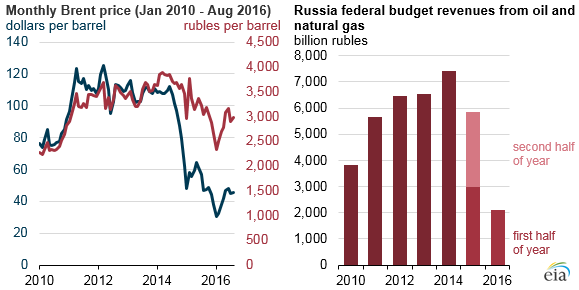

In June 2014, oil prices hit a record high of $114, and just six months later, a barrel of crude traded for $50 per barrel in January 2015. About a year later, a new nadir was reached: both Brent and WTI benchmarks fell below the $30 per barrel threshold.

Russia’s Central Bank preemptively switched the ruble to a free-float regime in November 2014, which helps offset losses from the collapse in oil prices.

So while Brent (which Russia uses to price its main export blend Urals) declined by 47% in 2015 versus 2014, and then another 31% in the first half of 2015, Russian federal budget revenues from oil and gas only fell by 21% and 29, respectfully.

Rosneft and Lukoil are two of the largest Russian oil companies, and together account for about half of the 11 million barrels of crude oil that Russia produces per day. Following the oil price crash, in 2015 Rosneft increased capital expenditures for exploration and production by 30% compared to the previous year. On the contrary, Lukoil’s expenditures on exploration and production projects fell by 11% in the same time period (see figure below).

The EIA notes that the favorable tax structure and exchange rates are responsible for bringing production to record highs.

With the exception of independent producers such as Lukoil and Novatek, the majority of Russian oil and gas companies are state-owned, and the Russian government, as the main stakeholder, collects dividends. In April 2016, the Russian government ordered state-controlled companies to pay 50% of 2015 net income out as dividends, nearly double the dividends companies would normally pay, according to the EIA report.

Low oil prices and Western sanctions hit Russia just as the economy was losing steam and heading into a recession. At present, Russia has a budget deficit of 3.3% of total economic input, and many ministers are pushing for higher taxes for the oil and gas industry to fill the gap.

Louise Dickson