What does the Russian oil sector look like in figures? Generally speaking, Russian oil companies jointly produce a bit more than 500 mn tons of crude oil per year. Half of this amount is exported outside of Russia, and the remainder goes to local oil refineries. Around 50% of oil derivatives produced in Russia stay in the country, the rest goes abroad. In other words, around 75% of oil products (crude oil, petroleum, diesel etc.) are being exported.

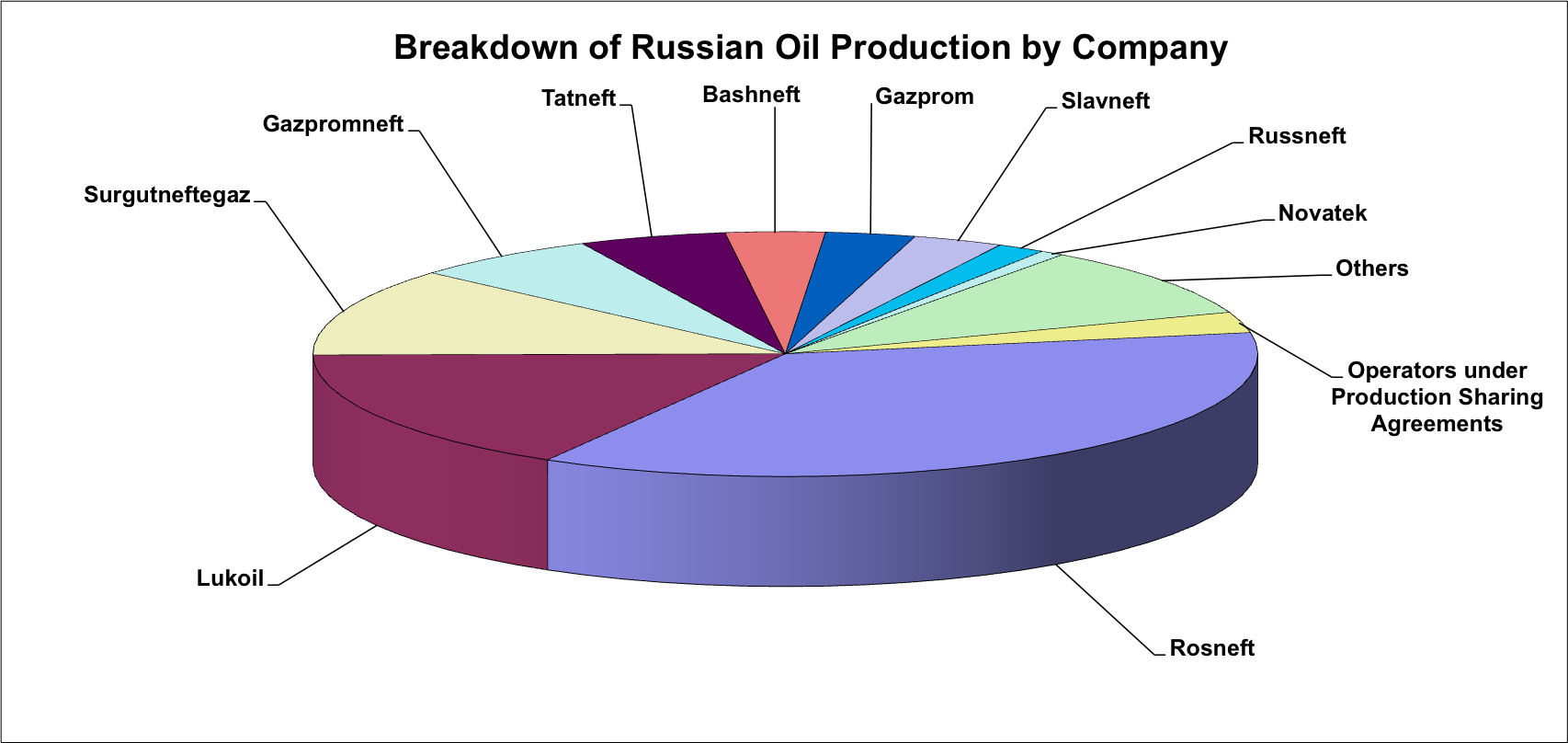

According to Russia’s Central Energy Dispatch, 526.7 mn tons of oil including gas condensates were extracted in 2014. State giant Rosneft tops the list of producers (190.1 mn tons) ahead of Lukoil (86.6), Surgutneftegaz (61.4), Gazpromneft (33.6), Tatneft (26.5), Bashneft (17.9), Gazprom (16.2), Slavneft (16.2), Russneft (8.6), NOVATEK (4.3). The remaining 50 mn tons of crude oil were produced by other minor companies and firms, working under PSA.

Attentive readers would probably notice that these figures differ from what we usually see in the companies’ official reports. Rosneft, for instance, claims its daily production is 4.2 mn barrels. Multiply that by 365 (days in a year) and divide by 7.3 (number of barrels in a ton) and you will get 210 mn tons per year. The difference usually comes from a complex share structure of oil companies with many offshore affiliates and owners. Russia’s Central Energy Dispatch statistics only take into account proven owners this is why their figures are always smaller than those of the oil companies.

Similar ownership nuances significantly distort “other producers” statistics. Russia’s Central Energy Dispatch places around 180 in this category mostly because it’s impossible to place those companies into any other category. However, it is incorrect to say that all 50 mn tons of crude oil are produced by small private companies. In this category one may find a company such as Tomskneft (10 mn tons per year, jointly owned by Rosneft and Gazpromneft), Salym Petroleum (6.6; Shell and Gazpromneft), Arktikgaz (2; NOVATEK and Gazpromneft), Nortgaz (1.5; Gazprom) and even state-owned Zarubezhneft (3.2). According to independent estimates, the real private oil companies annually produce around 25 mn tons.

In 2014 Russian oil refineries processed 288.9 mn tons of crude oil and jointly produced 38.3 mn tons of gasoline, 10.9 mn tons of jet fuel, 77.3 mn tons of diesel fuel and 78.4 mn tons of fuel oil. Quite expectedly Rosneft tops this chart as well having processed 77 mn tons in 2014. Lukoil (45.1), Gazpromneft (32.1), Bashneft (21.7), Slavneft (15.3) and Gazprom (5.8) found themselves behind. Those companies produce almost all Russian fuels. Oil refineries, which don’t count as part of oil companies, simply do not have enough money to invest into European fuel producing equipment. In 2014, Antipinsky, Afipsky, Ilsky, Mariysky, Novoshakhtinsky, Yaisky and Yaroslavsky oil refineries jointly processed 34.5 mn tons of crude oil having produced 0 tons of fuel. Meanwhile, small Russian oil refineries only processed 8.7 mn tons and produced 0.25 mn tons of gasoline and 0.16 mn tons of jet fuel.

The Russian federal customs service says 223.4 mn tons of crude oil worth $153.9 bn was exported in 2014. Russia sold abroad 164.8 mn tons of oil derivatives worth $115.6 bn. This means that one ton of crude oil cost $689, one ton of oil derivatives – $701. Such a small difference can be explained by the fact that Russia traditionally sells little fuel abroad, while the so-called “wet fuel”, which is cheaper than crude oil, makes the most part of the country’s export.

Exporting wet fuel is more profitable compared to selling gasoline due to the reduced customs rates.