After a momentous rally this year, it looks like oil prices are finally coming under pressure – with the threat of inflation dampening oil market optimism. The months-long oil price rally hit the pause button this week, following a shift in outlook from the U.S. Federal Reserve. “Inflation is your friend until it isn’t,” Louise Dickson of Rystad Energy said in a statement. “The oil market is re-learning this lesson in the past two trading days after the US central bank hinted at potential interest rate hikes in 2023, which would make oil more expensive in non-dollar denominated economies and could damper demand.”

But India’s oil demand rebounded in the first half of June, offering bullish momentum to the oil market. Sales of the nation’s two most-used road fuels rose as much as 13% from the same period last month, according to people familiar with initial data from the three biggest retailers. That’s the first monthly increase since March, Bloomberg said. The South Asian nation is emerging from the Covid-19 wave that overwhelmed healthcare infrastructure and triggered localized lockdowns, leading to a slump in fuel consumption and cuts in processing by refiners. Now, daily cases have sunk back below 70,000 from more than 400,000 at the outbreak’s peak, and curbs are being eased. Indian Oil Secretary Tarun Kapoor told Bloomberg TV that he expected the demand recovery to accelerate. Global energy demand is fast recovering from the devastation wrought by the pandemic, and the positive signal from India will help to support the bullish narrative.

Brent crude, the global benchmark, has rallied back above $70 a barrel, and leading traders including Trafigura Group and Glencore Plc say that more gains are in store. India is a leading oil importer, taking the bulk of its cargoes from producers in the Middle East, including Saudi Arabia and Iraq. Many oil traders see oil remaining above $70 per barrel for the foreseeable future, with $100 oil no longer an impossibility. And demand expected to return to pre-pandemic levels in the second half of 2022. As oil climbs above $70 a barrel for the first time in almost three years, oilfield firms are reporting prices for their services and equipment have bottomed and many are fielding more calls for jobs, Reuters said.

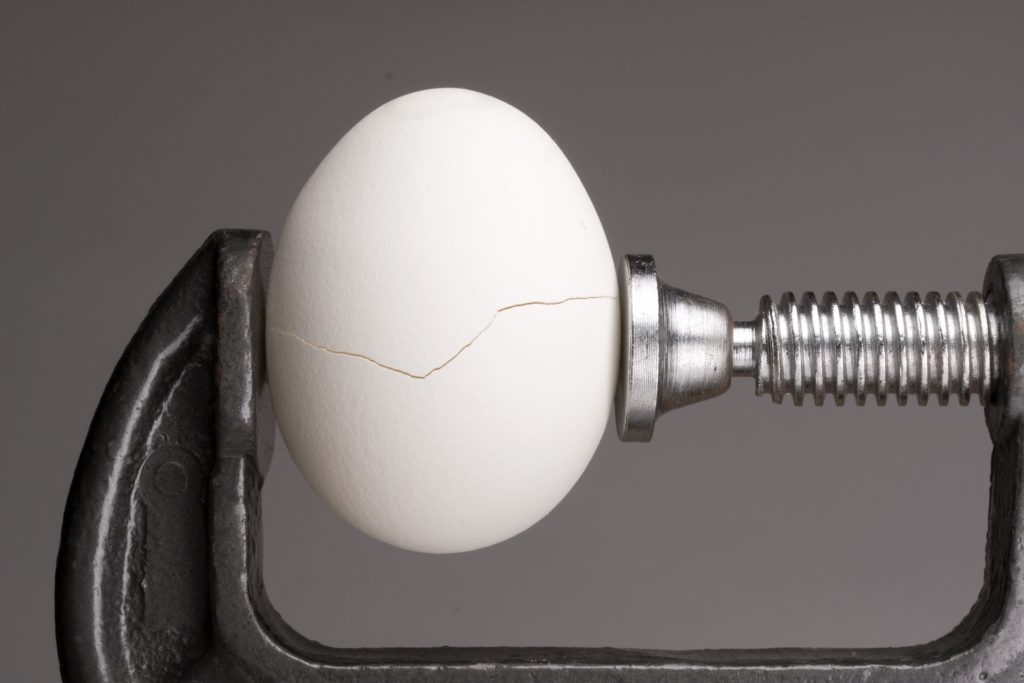

It’s too late to avoid supply crisis. The level of drilling and by extension capital investment is insufficient and has been for a number of years to sustain oil production at current levels. The lack of new drilling will start to show in a decline in production as early as next year. “There are a number of observable trends in oil supplies and by extension prices, presently. I am going to discuss one of them. A lack of capital investment in finding new supplies of oil and gas. A favorite analogy of mine comes to mind, the ship is nearing the dock. In nautical parlance that means the time for course corrections is at an end. So we shall see if that is the case for oil. The massive “ship” that is world oil demand is on an unalterable collision with supplies that will have profound implications for consumers. This key metric reveals what the future is likely to hold for our energy security as the world continues to recover from the virus to those who will listen”, David Messler said. “The level of drilling and by extension capital investment is insufficient and has been for a number of years to sustain oil production at current levels. It’s no secret that even with the lower break-even costs for new projects thanks to cost-cutting by the industry the last few years, oil extraction is a capital-intensive business”. https://oilprice.com/Energy/Energy-General/Its-Too-Late-To-Avoid-A-Major-Oil-Supply-Crisis.html

The super-major cohort formed by Shell, ExxonMobil, BP, TotalEnergies, all prime targets of the anti-oil movement, have reduced their capital allocation toward petroleum, exited businesses or converted petroleum assets like refineries to renewables, and sold assets that a few years ago might have contributed to oil and gas inventories. “The message to oil and gas companies has been pretty clear from the market, investment funds like Blackrock seeking green “purity” in the allocation of financing of new energy sources, and government edicts mandating carbon intensity reduction across the entire swath of society, and a transformation to renewable energy, that new supplies of oil and gas are not wanted. These companies seem to have gotten the message, loud and clear”, Messler said.

Sumitomo withdraws from new oil development. Sumitomo Corp. has decided to no longer develop new oil reserves and transition its fossil fuel business to renewables over time.Oil traders transition to both oil and renewables. Vitol said that it aims to have 50% of its investments in renewables, gas and power, and the other 50% in oil within five years. Other traders are viewing a similar transition. “We will keep oil trading activities as we see strong demand for oil in the next 10 years,” said Torbjorn Tornqvist, CEO at Gunvor. “We are also increasing our power trading, investing in technologies to decarbonize, and looking at existing solar and wind assets.”

But renewables boom has barely impacted fossil fuels.Oil, gas, and coal still represent over 80 percent of final energy consumption, not much different from a decade ago, despite the rising share of renewable energy in the world’s total energy consumption. “To be fair, fossil fuel use has dropped in overall global energy consumption over the past decade, but by a meager 0.1 percentage point, from an 80.3 percent share back in 2009 to 80.2 percent in 2019, a new report from REN21, a global renewable energy community advocating for a transition to clean energy, showed”, Oilprice said.

OPEC urges members to continue oil investments.The energy transition should not crowd out any source of energy as all energy sources of today will be required for the foreseeable future, OPEC Secretary-General Mohammad Barkindo said.OPEC sees little shale growth this year, more in 2022.OPEC officials heard from industry experts that U.S. oil output growth will likely remain limited in 2021 despite rising prices, OPEC sources told Reuters. “The general sentiment regarding shale was it will come back as prices go up but not super fast,” said a source. “It looks like the shale oil genie is going to stay in the bottle for now,” said the source, adding: “OPEC and Saudi Arabia have a lot of power at this timeIraq plans to boost the production capacity of West Qurna 1 by 40% to more than 700,000 b/d over the next five years.