On September 28, Gazprom’s Board of Directors will discuss fixing new export contracts in rubles, instead of dollars.

RIA Novosti first reported the development, after seeing the agenda of the upcoming meeting. However, this is an issue that Gazprom has already been discussing for a year and a half.

Western sanctions on the Russian oil and gas industry have made the conversation all the more relevant, since the Kremlin thinks a move towards ruble-based sales would slightly protect Russia from sanctions.

The idea is that more ruble-denominated product on the market will create a more robust demand for the ruble, and ultimately strengthen it. In the last year, the Russian ruble has lost more than 40 percent of its value.

Industry experts don’t expect a change anytime soon, Kommersant reported, citing sources who believe the gas giant is just preparing to for a brief on the fuel and energy sector to the president. Others believe Gazprom wants to hedge itself after the US sanctions on the offshore Yuzhno-Kirinskoye field, one of Russia’s largest gas reserves.

Whether its business or politics, settlements in rubles will not be useful until there is a functioning financial infrastructure. However, this infrastructure cannot just appear out of thin air, it has to develop alongside ruble pricing on export contracts.

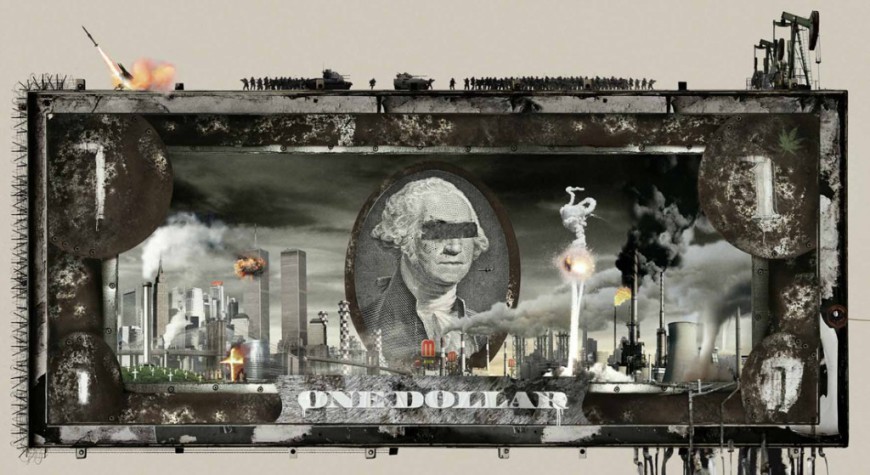

Moscow has always viewed the sale of crude oil as an unjust dollarization of the global economy and the energy sector.

Gazprom could receive payments in rubles on short-term gas contracts, TASS reports. This could, in theory, apply to Gazprom’s last gas auction that ended September 10, when the company announced it had sold 1 billion cubic meters to be delivered to Europe, but did not disclose pricing.

Gazprom’s major gas deal with China’s CNPC could also provide an avenue to settle export payments in rubles.

In June, Gazprom’s general director Elena Burmistrova said that the companies are considering setting payments in rubles and yuan. In May 2015, just as sanctions against Moscow were ramping up over the annexation of Crimea, China signed a 30-year contract to supply 38 billion cubic meters per year from Russia.

Russia will pump natural from fields in Western Siberia and send it to China via the Power of Siberia 2 pipeline, which will deliver gas to Western China. The Power of Siberia will deliver to the east.

Last year, Gazprom Neft attempted to begin selling its product in rubles. Russian President Vladimir Putin acknowledged the need to switch to ruble payments but said “it’s not so simple.”

In late 2014, Russia’s Federal Antimonopoly Service, in reaction to the massive devaluation of the ruble, asked the Government to force oil and gas companies to settle export payments in rubles. The idea was dropped.

Global oil prices have been denominated in dollars since the end of World War II, since the US was both the biggest producer and consumer of world oil. Then, in 1973, President Nixon signed the famous ‘petrodollar’ agreement with Saudi Arabia, which set the trend of selling oil in dollars worldwide.

Each time a country sells oil or gas in its own national currency on a mass scale, the dollar weakens.